When shipping goods internationally, one of the most critical decisions is determining who covers the shipping costs and when the payment is made. This choice primarily comes down to two options: Freight Collect Vs Freight Prepaid. The decision impacts shipping payments, cash flow, customs procedures, and business relationships. By understanding the differences between these terms, businesses and individuals can avoid delays, prevent disputes, and optimize their global supply chain operations.

What is Freight Prepaid?

Freight Prepaid is a shipping arrangement where the seller covers the shipping costs before the goods are sent out from their location. This means the buyer doesn't have to worry about paying for shipping separately, as the seller covers all the logistics and expenses upfront.

Also Read: What are Demurrage Charges in Shipping?

For example, a company in China ships electronics to a retailer in the U.S. using Freight Prepaid. The Chinese seller pays the shipping costs to the carrier (like FedEx) before sending the goods. When the electronics arrive in the U.S., the retailer doesn't pay extra shipping fees because the seller has already covered them. This makes the process hassle-free for the retailer.

What is Freight Collect?

Freight Collect means the buyer pays for shipping, but only when the goods are delivered. The shipping company delivers the goods to the buyer and collects the payment at the destination. This way, the buyer covers the shipping costs after receiving the shipment.

For example, if a grocery store in Mexico orders fruits from a farm in Brazil using Freight Collect, the Mexican store will pay all shipping costs when the fruits arrive in Mexico.

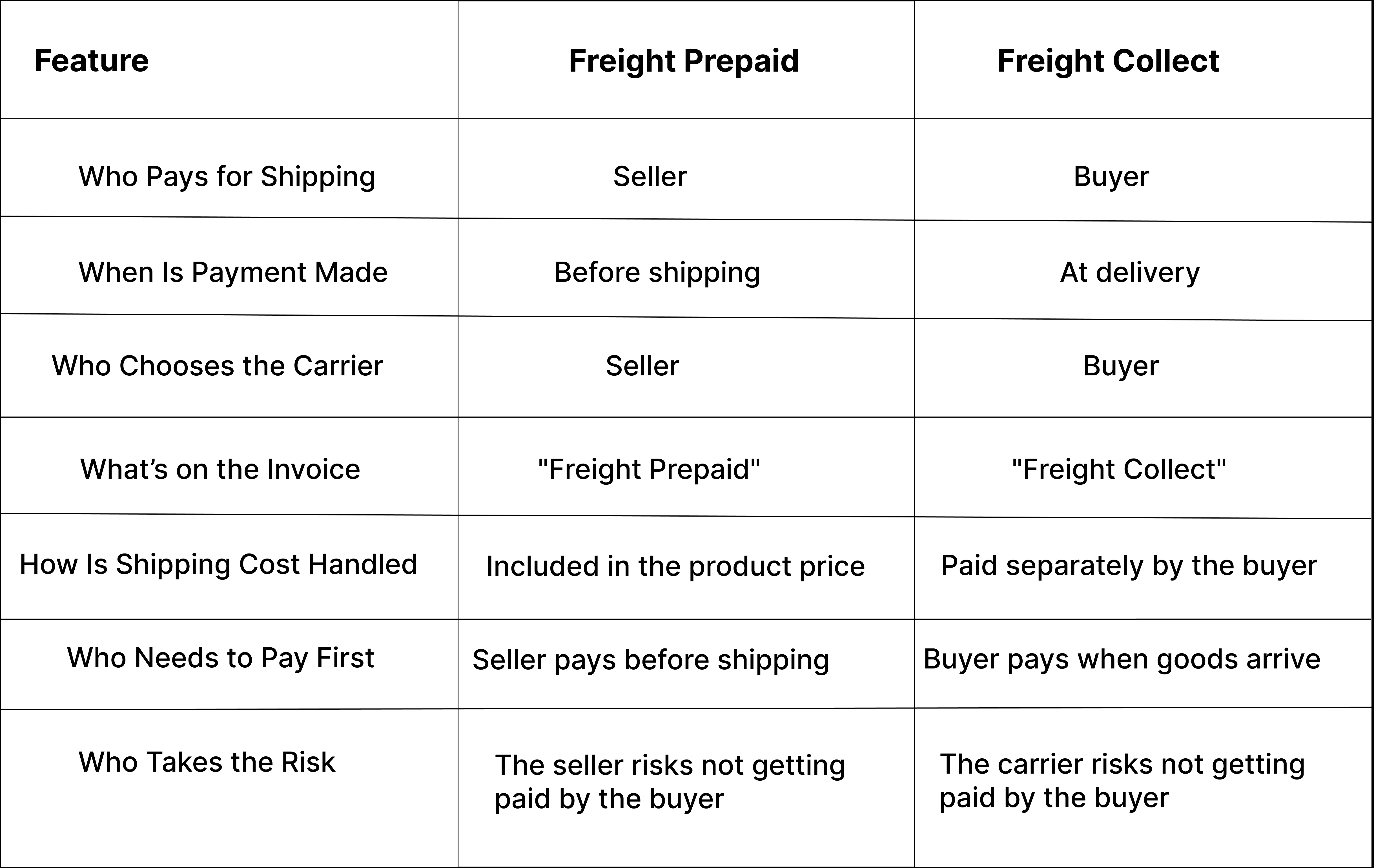

Freight Collect vs. Prepaid: Key Differences

Note: These terms only tell you who pays for shipping. They don't tell you who owns the goods during shipping or who's responsible if the goods are damaged. Those issues are covered by other terms called "Incoterms".

Drip Capital's Role in International Trade Finance

In international trade, buyers and sellers may face cash flow challenges when shipping goods, especially when dealing with upfront costs or delayed payments. Drip Capital steps in to provide tailored financial solutions:

- For sellers using Freight Prepaid: Drip Capital offers working capital loans to cover shipping costs upfront. This ensures sellers can pay carriers and ship goods without waiting for buyers to settle their invoices, keeping operations smooth and timely.

- For buyers using Freight Collect: Drip Capital provides financing to help buyers pay shipping fees when the goods arrive. This prevents cash flow disruptions, allowing buyers to manage their expenses more effectively while receiving their shipments on time.

By offering these solutions, Drip Capital helps both buyers and sellers navigate the financial complexities of international trade, ensuring smoother transactions and better cash flow management.

Choosing between Freight Collect Vs Freight Prepaid depends on what works best for your business. Neither option is automatically better. Freight Prepaid gives sellers more control but requires paying upfront. On the other hand, Freight Collect makes the buyer pay but gives them less control over shipping. Understanding these options helps businesses make better shipping decisions. Additionally, with support from Drip Capital, buyers and sellers can manage their finances more effectively, no matter which option they choose.

Frequently Asked Questions

1. As a seller, how does Freight Collect impact my cash flow?

As a seller using Freight Collect, you don’t pay for shipping upfront, which helps you keep more cash. This can improve your business’s available funds. However, you’ll have less control over shipping arrangements, and you may need to adjust your pricing strategy since shipping costs aren’t included in the product price.

2. How do Freight Collect and Prepaid relate to Incoterms?

Freight Collect and Prepaid decide who pays for shipping, while Incoterms (like FOB, CIF, EXW) cover broader details like shipping responsibility, customs, and insurance. For example, under FOB, the buyer pays for shipping (like Freight Collect), while under CIF, the seller covers shipping to the destination port (like Freight Prepaid).

3. When should a buyer choose Freight Collect?

A buyer should choose Freight Collect when they want to see shipping costs separately, have negotiated better deals with shipping companies, or plan to combine shipments from multiple sellers. It’s also a good option for buyers who have the funds available at the time of delivery or regularly import goods and have systems in place to handle shipping payments.

4. When should a buyer choose Freight Prepaid?

Buyers should choose Freight Prepaid for convenience, especially if they want a fixed total cost and prefer the seller to handle shipping. It’s useful when the seller has better shipping rates or if the buyer is new to importing and wants to avoid shipping arrangements. Some sellers may also offer flexible payment terms, making it an even better option.

5. Who pays for the shipping costs in a "Freight Prepaid" arrangement?

In a Freight Prepaid arrangement, the seller pays the shipping costs directly to the shipping company. However, the seller typically includes these costs in the price of the goods. This means the buyer indirectly pays for shipping as part of the total price rather than paying the shipping company separately.