Receivables Factoring Solutions for Suppliers in India

Find out what Receivable Factoring is, How Much Does it Cost & Solutions by Drip Capital

What is Receivables Factoring?

Account receivables factoring, or simply receivables factoring is a type of financial service that allows businesses to turn their outstanding accounts receivables into immediate cash as working capital solution. This capital can be used for business operations, to work on the next order or even for capital expenditure. A receivable, or a trade receivable is an outstanding payment that a seller or supplier is yet to receive from the buyer. A commercial trade invoice mentions the due date of payment against any particular receivable, which means the receivables are an asset. This means the seller is in possession of an asset that can either be sold or be pledged as a collateral for securing additional financing, just like any other asset (a house or a vehicle). In case of factoring, it is an outright sale of the trade receivable and is hence also referred to as receivables purchase - implying the purchase of a receivable by the factoring company.

Why do Companies Use Receivables Factoring Services?

Here are a few reasons why one should choose accounts receivable factoring as opposed to other traditional trade financing techniques. For one, it is much faster - since it is technically the sale of an asst, factoring companies can do away with lenghty compliance and documentation that is generally associated with a loan. Secondly, it is a facility that is offerred over and above the banking limits in India. For growing trading houses and exporters in India, this feature is quite beneficial as it allows them to access much needed capital to fuel business growth. Lastly, if the buyer or the importer defaults on this accounts payable, the factoring company assumes full responsibility and the supplier can focus on growing the business. These benefits make A/R factoring quite lucrative for domestic businesses and exporters alike

An Example of Accounts Receivable Factoring

Say Hindustan Construction Hardwares Private Limited sells agrees to sell Hardware worth ₹1,000,000 to Interglobal Hardware Retailers in Belguim. A commercial invoice is drawn that mentions the ₹200,000 will be paid upfront and the rest will be paid 30 days after shipment. Based on this agreement, Hindustan Construction Hardware finishes the production of the goods and ships them out. As per the invoice, Hindustan Construction Hardwares is now in possession of an asset valued at ₹800,000 - the trade receivable - that can be sold to an accounts receivable factoring company in return for a small fee.

How Does Receivables Factoring Work?

Why Choose Drip Capital?

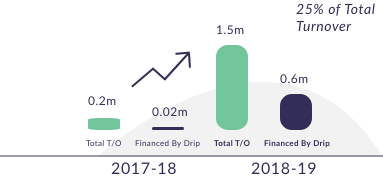

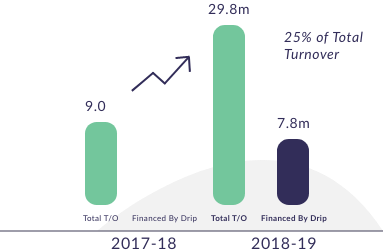

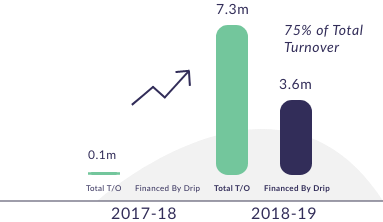

Why Choose Drip Capital's Receivable Factoring Service?

Drip Capital makes receivable factoring possible by financing up to 80% of the invoice value on the day of your export shipment (After submission of the shipping BL), while the remaining 20% minus the factoring charges is paid once the buyer makes full payment to Drip Capital.

We are a fintech company focused on solving the working capital problem for emerging market SME exporters by leveraging data and technology.

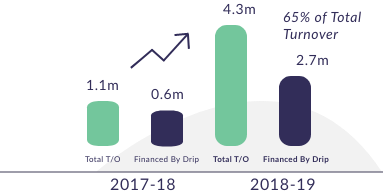

Quick facts on Drip Capital

$5 Billion+

Trade Financed

6,000

Buyers & Suppliers

100+

Countries

100,000

Cross-Border Transactions